All has been quiet on the municipal (Chapter 9) bankruptcy front for some time. Some might believe my two municipal bankruptcy articles, one about Stockton (Municipal Bankruptcy: When Doing Less Is Doing Best (download here or here)) and the other about Detroit (Who Bears the Burden? The Place for Participation of Municipal Residents in Chapter 9 (download here or here)), are only of antiquarian interest.

But some would be wrong. And we should see an uptick in the number of cities seeking bankruptcy protection over the coming two years.

Three reasons why. First, the underlying social causes of municipal financial distress have not changed. Go here to read an interesting post by Peter Leithart titled "Suburban Ponzi Scheme" in which he summarizes a yet-lengthier piece describing the governmentally-created structural supports that helped cause the post-WW II explosion in America's suburbs. The exodus from America's cities was driven not only by the desire of many urbanites to get a house with a lawn (or to put more distance between themselves and POC) but was enabled by federal spending on highways and other transfer payments that amounted to middle-class welfare. In addition, financing the infrastructure of suburbia has always been something of a Ponzi scheme. For example,

Second, the super-low interest rate environment is changing as the financial markets and the U.S. Federal Reserve begin to take seriously the return of inflation. Coupled with the promise of ever-more massive U.S. federal budget deficits thanks to Republican anti-deficit hypocrisy,** we can expect a continual upward climb in interest rates that will, in turn, unmask the low-interest-rate subsidy of municipal deficit spending.

Finally, the unsustainable costs of public employee pensions and retiree health care will force cities in some states, notably California, to join Stockton and San Bernardino (and don't forget Loyalton!) in hoping for help from a bankruptcy judge in Chapter 9. See a recent post by California public pension maven Ed Mendel here for the bad news. Or Joshua Rauh of the Hoover Institute here.

So, when all is said and done, at least the future for work in municipal financial restructuring and bankruptcy (debtor and creditor) looks bright.

* As I describe in yet another article, Nine Into Eleven: Accounting for Common Interest Communities in Bankruptcy, (download here or here), suburban cities have sought to offload the hemorrhaging costs of infrastructure by devolving them to common interest communities (homeowners associations and the like). As I explain in the article, this punt is likewise unsustainable in the long run.

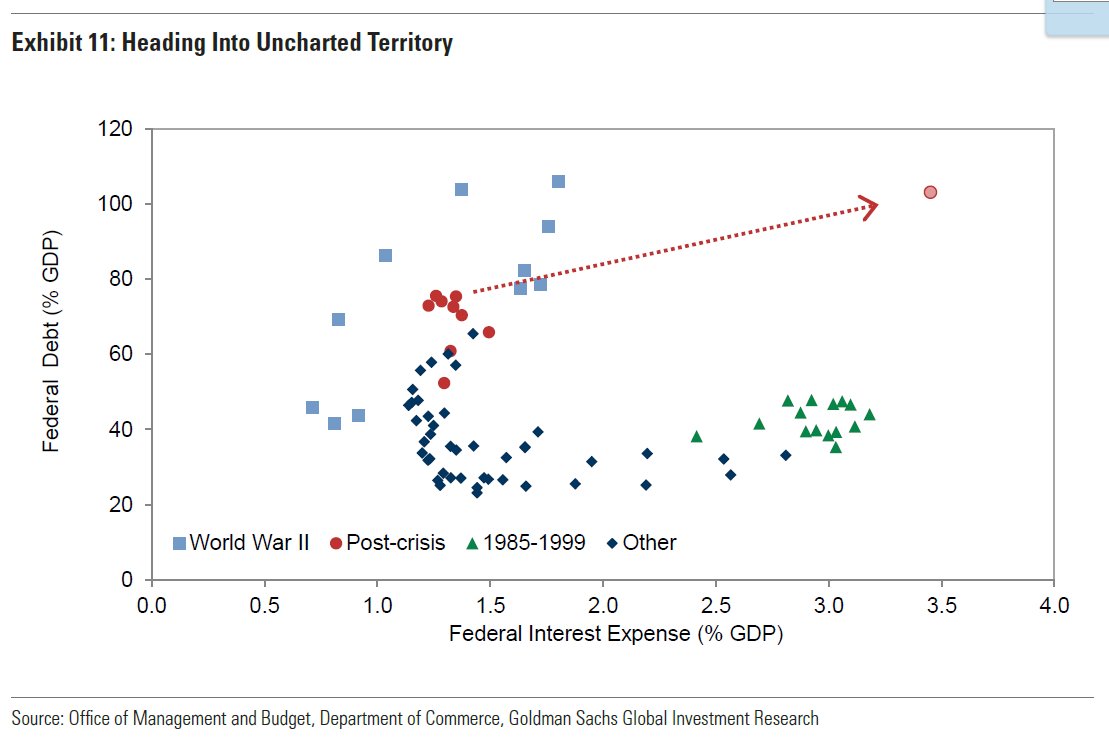

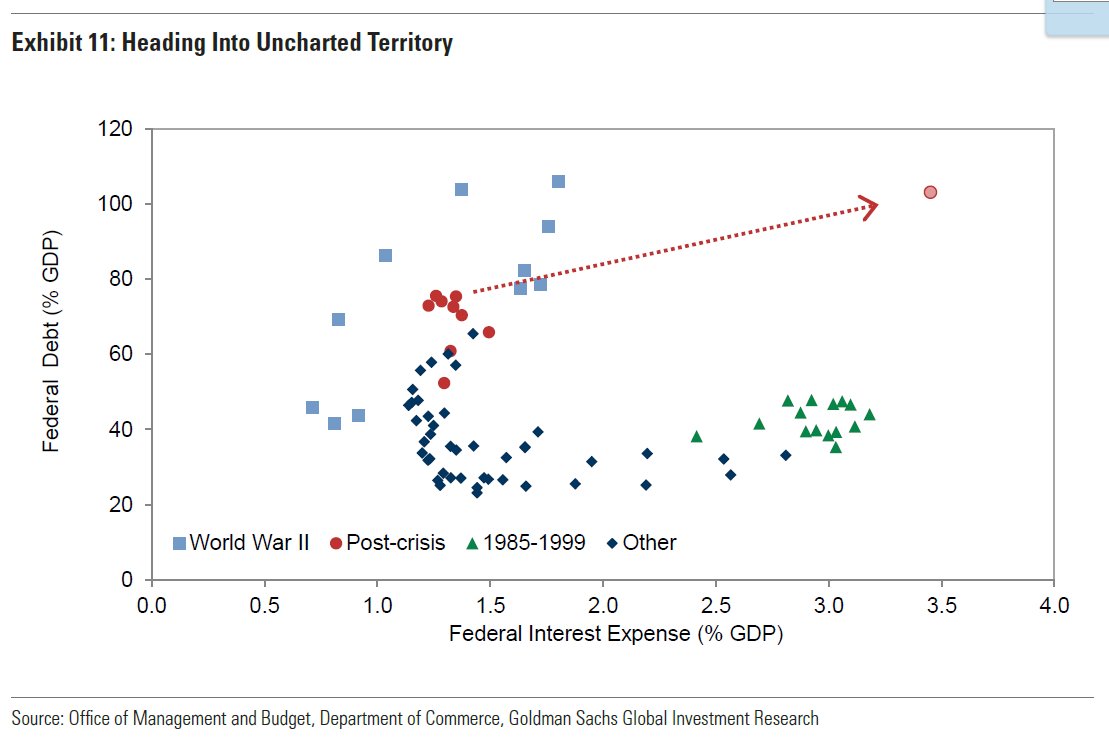

** U.S. debt heading into orbit. "Goldman estimates U.S. federal debt will be over 100% of GDP and interest expenses will jump to 3.5% if tax/fiscal plans are enacted, 'putting the U.S. in a worse fiscal position than the experience of the 1940s or 1990s.'"

But some would be wrong. And we should see an uptick in the number of cities seeking bankruptcy protection over the coming two years.

Three reasons why. First, the underlying social causes of municipal financial distress have not changed. Go here to read an interesting post by Peter Leithart titled "Suburban Ponzi Scheme" in which he summarizes a yet-lengthier piece describing the governmentally-created structural supports that helped cause the post-WW II explosion in America's suburbs. The exodus from America's cities was driven not only by the desire of many urbanites to get a house with a lawn (or to put more distance between themselves and POC) but was enabled by federal spending on highways and other transfer payments that amounted to middle-class welfare. In addition, financing the infrastructure of suburbia has always been something of a Ponzi scheme. For example,

A small town received support to build a sewer system from the federal government back in the 1960s as part of a community investment program. Additional support was given in the 1980s to rehabilitate the system. Today, the system needs complete replacement at a cost of $3.3 million. This is roughly $27,000 per family, which is also the city’s median household income.In other words, only by betting on continuous growth can suburbia continue to exist. Such growth has come to an end in many suburban communities and thus it is only a matter of time before some of them join the ranks of their forsaken big-city parents and seek Chapter 9 bankruptcy protection.* (I could say more about the demographic trends that augur ill for many urban and suburban communities but I'll merely send you to an earlier post here.)

Second, the super-low interest rate environment is changing as the financial markets and the U.S. Federal Reserve begin to take seriously the return of inflation. Coupled with the promise of ever-more massive U.S. federal budget deficits thanks to Republican anti-deficit hypocrisy,** we can expect a continual upward climb in interest rates that will, in turn, unmask the low-interest-rate subsidy of municipal deficit spending.

Finally, the unsustainable costs of public employee pensions and retiree health care will force cities in some states, notably California, to join Stockton and San Bernardino (and don't forget Loyalton!) in hoping for help from a bankruptcy judge in Chapter 9. See a recent post by California public pension maven Ed Mendel here for the bad news. Or Joshua Rauh of the Hoover Institute here.

So, when all is said and done, at least the future for work in municipal financial restructuring and bankruptcy (debtor and creditor) looks bright.

* As I describe in yet another article, Nine Into Eleven: Accounting for Common Interest Communities in Bankruptcy, (download here or here), suburban cities have sought to offload the hemorrhaging costs of infrastructure by devolving them to common interest communities (homeowners associations and the like). As I explain in the article, this punt is likewise unsustainable in the long run.

** U.S. debt heading into orbit. "Goldman estimates U.S. federal debt will be over 100% of GDP and interest expenses will jump to 3.5% if tax/fiscal plans are enacted, 'putting the U.S. in a worse fiscal position than the experience of the 1940s or 1990s.'"

No comments:

Post a Comment